(ANALYSIS) How Philippines is losing its way by Dan Steinbock

The economic dreams that were so close within the Philippines reachable in the last few years have faded. The strong political noise that hound the country will not hinder the rate of growth in the economy as the country has sound and sustained polices on growth, the National Economic and Development Authority, NEDA said on Thursday. Unsurprisingly, NEDA Secretary Arsenio Balisacan

Reading Dan Steinbock’s How PH is losing it’s way, it is clear that the Philippines is actually on a wrong track.

It has been predicted that the economic future that was easily achievable In the Philippines some three years ago is gradually becoming a dream.

Political clamor will not hinder the performance of the economy because the Philippine government employs sound and sustained policies as claimed by the National Economic and Development Authority (NEDA) on Thursday.

Not surprisingly, NEDA Secretary-designate Arsenio Balisacan, released the statement following his briefing to President Ferdinand Marcos Jr., Senate President Francis Escudero and Speaker Martin Romualdez in Malacañang.

Furthermore, the economy is not immune to flames of politics to the reality.

Forget BRIC-like futures

“No politicization of economy will happen;” Balisacan stated. Thus, statement “Our economic policies, our economic policy directions are sound and sustained.” is platitudinous but it has much of truth in it.

The political race in the Philippines has sharply grown intense over the year and specially in the recent weeks, combined with China hostility and move to firmly anchor Manila’s path to the liberal front of the Indo-Pacific.

There is a great risk because stranger alignments have led to the displacement and destruction of property in Ukraine and Gaza, and have a potential to be even more destructive in Taiwan Straits and Southeast Asia.

Depending on the headlines and arguments of the political elites that have come out of this issue, the goals are arguably political at the moment. At the same time, Philippines’ economy is falling from one swoon to another. Thus, the attempt to reassure the constituencies that everything is okay.

Actually, after the pandemic, the process of pauperization and high inflation rates deprive Filipinos of promising economic opportunities. There can be no BRIC-like future in the Philippines as long as Filipino leaders would not focus on the Filipino people and their sore need to fight against poverty.

Economic growth: expectations vs. realities

In the beginning of the year, US news agency Bloomberg questioned President Marcos Jr whether Philippines could reach 8% growth rate. “Why not?” the president replied. “Well, yes, I believe it is possible yes I believe that it is possible.”

Marcos said that the economic growth of the country should reach up to 7% for the year 2024.

However, the gdp year year increase was only at 5.2% in the third quarter of 2024. Specifically, in the past three quarters, the figure has increased by only 4.8% compared to the corresponding period of the previous year; and this growth rate is the lowest in terms of the post-pandemic quarters. From the historical perspective, something like this was observed for the last time in the late November 2011, that is, almost thirteen years ago.

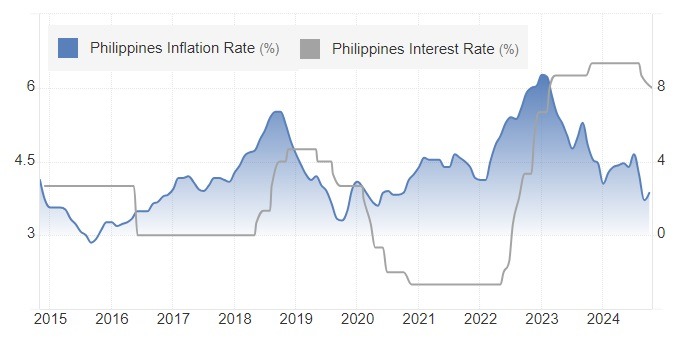

It was probably attributed by the slow credit growth, high inflation rate over the past 1.5 years and badly growth in other products like durables equipment’s.

Furthermore, unemployment ratio increased up to 4,7% during July which is prior to the rainy season because new employment was low in construction, services, and agriculture.

Potential for negative turns

Fixed investment, as well as supporting the growth of consumption spending, increased by 6% year-on-year in the first half of the year and net exports. While the former bets on the increase of debts, the latter presupposes continuity.

The situation is that in several months both will rise more and more due to Trump trade and technology war.

Basically in the expected, most analysts foresee higher growth with the reduction of inflation up to 2025, something that should be a respite to household consumption capability.

Nevertheless, this scenario rests on more expected rate cuts and that inflation rate goes below the predicted level. Both of them are influenced by the US rates and inflation; this is due to the fact that the Philippines is now more economically tied to the west and more so the US.

Source: Philippine Statistics Authority; author

That is, he explicitly stated that inflation “will disappear completely” in America under his presidency. That, of course, is baloney. Thus, it may be stated that Trump’s policy proposals are likely to resulted in increased inflation rates in the country.

Trump’s policies such as placing steep tariffs on imports, deporting millions of workers, and seeking to influence the Federal Reserve’s interest rate track would push prices higher, 16 economists who won the Nobel Prize in economics stated this in June.

Trade deficit adversities

Not only has the Philippine trade deficit persistently deteriorated, in recent period it has registered its biggest expansion in more than two years. Trade deficit of the country increased to 43.4 % in September 2024, which represents the highest since 81.1% in August 2022 as a result of the pandemic fall.

In September the major trading partners of Bangladesh were United States accounting for 17.3%, Hong Kong 13.9%, Japan 13.5% and China 13.3%. China remained the largest import supplier in September 2024, contributing to 25 percent of the total imports in the country and which was far more than the second largest import suppliers that include Indonesia or Japan.

Here’s the problem. The result was hinh that as the friction between Philippines and China rises sharply, its largest trading partner Hong kong/China (27% for both) has long term negative prospects. Thus, there are alternatives but all of them will contribute to rather than decrease the inherent economic cost.

If geopolitical friction creeps into Bilateral trade it would be very much unfavorable to Philippines since the attractive price of Chinese products will be subjected to the new cost and lead to the promotion of inflation.

Misguided trade wars and geopolitics

Most ASEAN countries import energies from the US hence they cannot escape the repercussions when Trump administer 10-20% on imports of all good from all countries, including 60% on Chinese imports. However, some other issues remain on increased security threats because Manila had committed allegiance to prompt American military relations.

Such tariffs could cut the export levels originating from non-China Asia countries by 3% and even more. The countries of ASEAN which expect to become recipients of investment if such multinationals shift away from China, loudly proclaim their economic and geo-political allegiance to the US. And for that reason, new tension has arisen between Manila and Beijing through attempt to purchase new US mid-range missiles that Beijing refers to as a ‘provocative’.

These geopolitical considerations make the Philippines – the State of Southeast Asia 2024 survey shows – an exception to the region.

The kind of development that can be imagined to change the living standards of people is not derived from missiles and geopolitical contests. Some political problems with China have not prevented Indonesia, Vietnam, Malaysia and other ASEAN countries from achieving economic development on this basis.

Share

Share