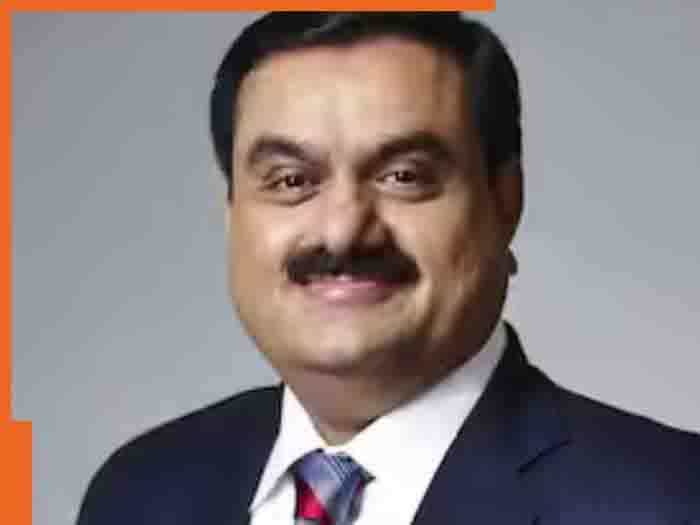

Rating agency Moody's has downgraded the credit outlook of seven major units of the Adani Group from 'stable' to 'negative'. This step was taken after allegations of alleged bribery against the group's chairman Gautam Adani and some other senior management officials. These allegations are likely to have a negative impact on the company's access to financing and cost of capital.

Which units were affected?

The seven Adani Group entities on which Moody's has taken action include Adani Ports and Special Economic Zone Limited, two restricted groups of Adani Green Energy Limited, Adani Transmission Step-One Limited, Adani Electricity Mumbai Limited, and Adani International Container Terminal Private Limited.

The rating agency says that the ongoing legal proceedings against the Adani Group may result in the financial stability of the group being affected. However, Moody's also indicated that if these legal matters are resolved without any negative impact, the rating can be changed back to the 'stable' category.

Fitch increased monitoring, took a tough stand on bonds

Fitch Ratings has put some bonds of the Adani Group on a 'negative watch' list. This includes Adani Energy and Adani Electricity Mumbai Limited. Fitch said that this move reflects risks in the corporate governance of the group, which may affect cash flow and access to financing.

An eye on financial stability shortly

Fitch says that some units of the Adani Group have sufficient cash available for the next 12-18 months and there are no major debt maturities during this period. However, the rating agency will monitor any long-term impact on the group's financial position and corporate governance.

Challenges for Adani Group

The ongoing legal proceedings against Gautam Adani and his senior management officials have had a profound impact on the group's credibility. This may increase the cost of raising capital and a decline in investor confidence.

Is improvement possible in the future?

Both Moody's and Fitch believe that the Adani Group's rating and credit outlook may improve if the legal cases yield positive results. However, at present, restoring trust among investors and financial institutions is a big challenge for the Adani Group.

It is worth noting that in this period of financial and legal pressure, the Adani Group will have to pay special attention to its strategies and transparency. This action of Moody's and Fitch has not only exposed the current situation of the Adani Group, but has also increased the risk to investors and the market.

Share

Share